In the intricate global market, where aromas mingle with economic trends, 2024 marks a pivotal year for forecasting coffee prices. The coffee market is on the brink of reaching a substantial $93.2 billion worldwide, a testament to the enduring love for this beloved beverage. This impressive figure isn’t stagnant but poised for growth, projecting a robust annual increase of 4.41% from 2024 to 2028 (CAGR 2024-2028).

Zooming into the heartbeat of coffee commerce, the United States emerges as the global frontrunner, contributing the highest revenue share with a noteworthy $11,440 million in 2024. This signals a nation deeply entwined with its coffee culture, where the love for a good cup of java translates into significant economic contributions (Statista, 2024)

“Our coffee price forecast for 2023, 2024 and 2025 is directionally bullish, with the coffee price set to double by 2025. This is driven by 3 leading indicators: global supply/demand conditions, Brazilian Real, coffee CoT.”

Investinghaven

Predicting Global Supply and Demand

The essence of forecasting coffee prices lies in carefully examining the delicate balance between global supply and demand. Citing a comprehensive report from June 2023, Taki Tsaklanos anticipates a rise in world coffee production for 2023/24. Notably, there’s an expected surge in output from coffee powerhouses Brazil and Vietnam, potentially offsetting the reduced production observed in Indonesia. This underscores the reliability of global supply and demand conditions as key indicators for forecasting coffee prices.

As we delve into 2024, keeping a watchful eye on these supply and demand dynamics will be pivotal for gauging price trends. Taki Tsaklanos methodology at investinghaven.com underscores these factors’ crucial role in determining the longer-term trend direction in coffee prices.

Currency Influence

The currency exchange intricacies wield considerable influence in the coffee market, with the Brazilian Real playing a pivotal role. A positive correlation links the value of the Brazilian Real to coffee prices. Therefore, any fluctuations in the Brazilian Real against the US Dollar can send ripples through the coffee market, impacting prices. Navigating this currency landscape is critical for comprehending the ebb and flow of coffee prices in the upcoming year.

Coffee’s COT Report

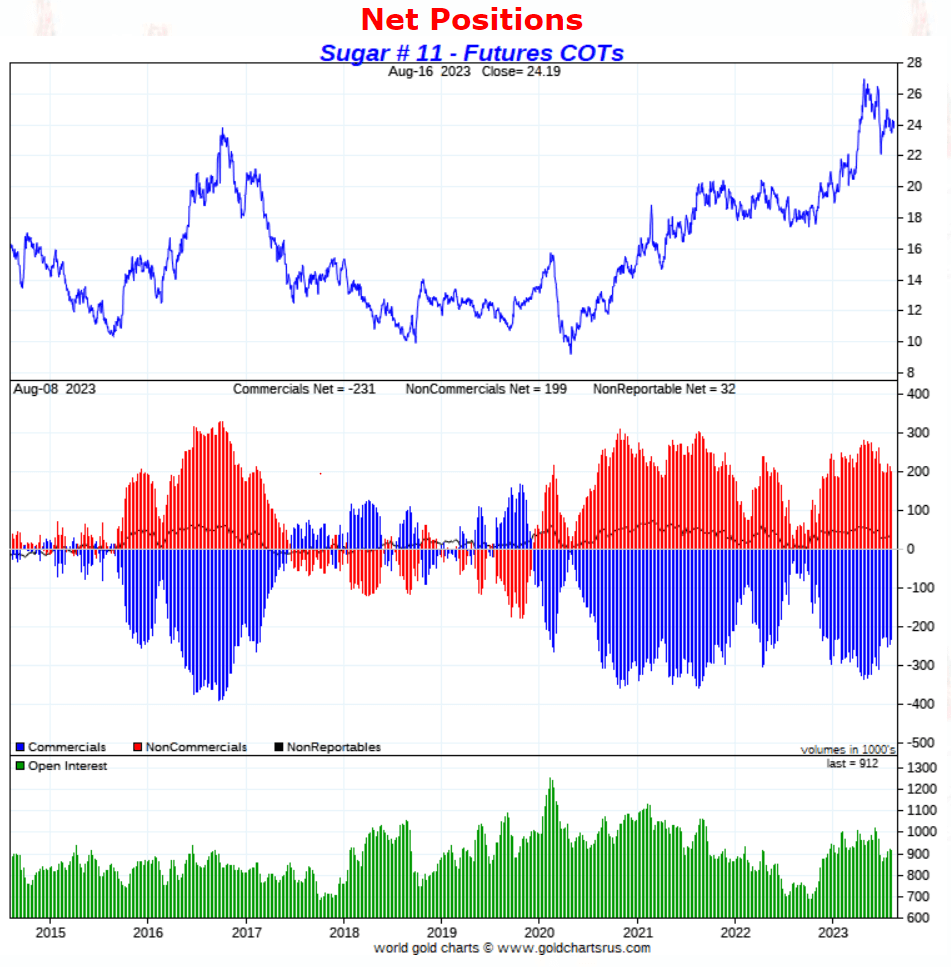

In the realm of coffee price forecasting, the ‘Commitment of Traders’ (COT) report emerges as a powerful ‘stretch indicator.’ It hinges on the net positions of commercial and non-commercial traders, spotlighted through the interplay of blue and red bars on the chart.

When commercial traders’ net positions are exceptionally low (small blue bars), it signals significant upside potential but limited downside risk. Larger blue bars suggest the inverse. While not a precise timing tool, the COT report acts as a guide, indicating risk-reward dynamics.

Reviewing 9-year COT statistics (as of mid-August 2023), the bars show an average size, presenting a neutral stance. This aligns with the methodology outlined by [Source], suggesting a balanced equation of upside and downside potential for coffee prices.

In the intricate dance of coffee forecasting, the COT report, while supportive, complements the insights drawn from global supply and demand and currency dynamics. It contributes directional insights, emphasizing a holistic approach to market analysis.

Forecasting Coffee Prices

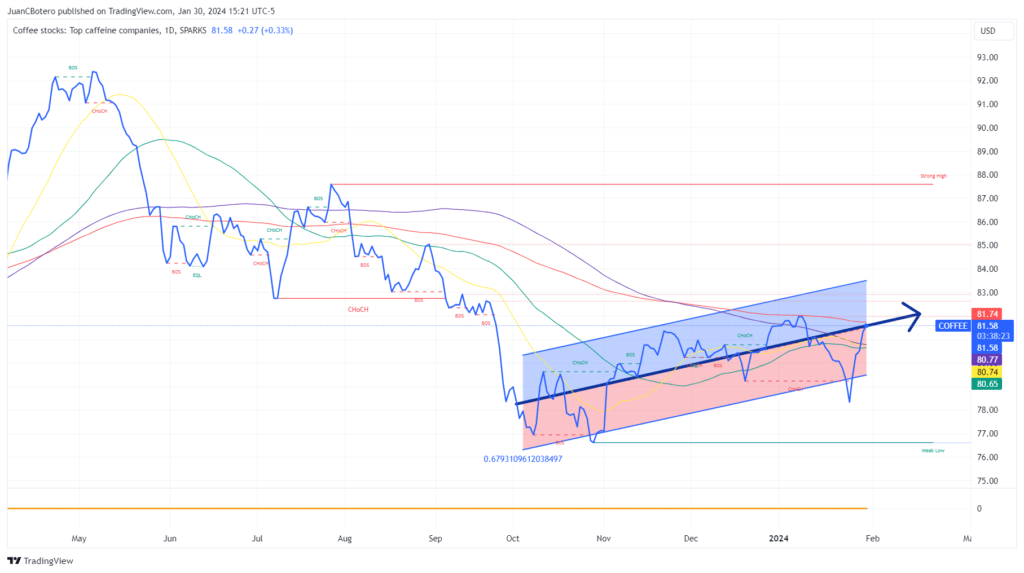

Synthesizing global supply and demand, currency dynamics, and insights from the COT report, our coffee price forecast for 2024 creates a compelling narrative. We foresee a doubling of coffee prices by 2025, rooted in optimistic supply and demand trends globally. The Brazilian Real plays a pivotal role, coupled with strategic utilization of Coffee COTs as leading indicators, reinforcing our positive outlook. However, it’s crucial to approach these predictions cautiously. Unforeseen factors, like climatic changes or global economic downturns, could markedly reshape the trajectory of coffee prices.

Conclusion

As we delve into the intricate nuances of the 2024 coffee market, it’s essential to grasp the ever-changing nature of this industry. Our forecasts provide valuable insights, yet it’s critical to remain vigilant. Unforeseen factors, from climatic shifts affecting crops to global economic fluctuations, can significantly influence prices. The coffee market is dynamic, demanding stakeholders, including Meni Coffee, to adapt to evolving trends.

At Meni Coffee, we make concerted efforts to uphold price stability throughout the year by proactively adjusting to various variables. Our goal is to provide clarity and consistency to our valued customers. However, it’s important to note that this year may present unique challenges to this commitment. We’re navigating a potentially complex landscape, and your understanding is greatly appreciated as we work diligently to minimize any potential confusion. In 2024, the coffee market emerges as an arena of resilience and adaptation. Producers and consumers alike must stay attuned to emerging dynamics.

Please note that this article is for informational purposes only and should not be considered as financial advice.

No Comments yet!